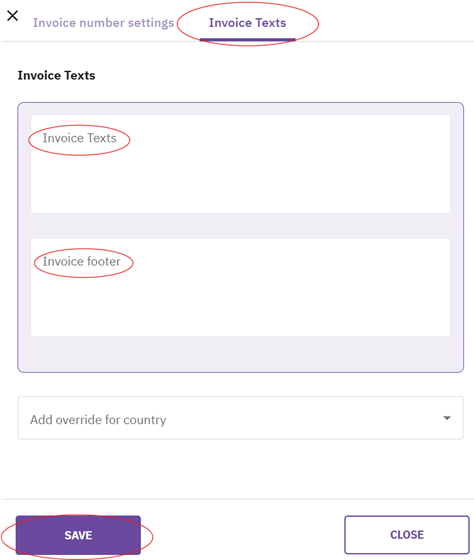

Invoice (Orders/Pro-forma Invoice, Cancelation) Settings

After you have chosen the option of order-invoice flow, and you have set your payment options (Offline and/or Online), now is the time to set properly your orders/pro-forma invoices and invoices.

Invoicing (Tax Invoices and e-Invoices) features include:

- Automatic Tax Invoices: Instantly generate compliant invoices for every transaction, with customizable formats and branding.

- e-Invoicing Ready: Support for EU-standard e-invoicing protocols like XRechnung, Factur-X, and Peppol. E-Invoicing with run.events (EN16931 / ZUGFeRD / Factur-X)

- Multi-Currency & VAT Logic: Built-in support for international tax rules and VAT calculations.

- Integration With Registration & Sales: Invoices are automatically linked to registrations, tickets, and payments.

- Downloading & Emailing: Attendees and partners can access invoices anytime via portal or email.

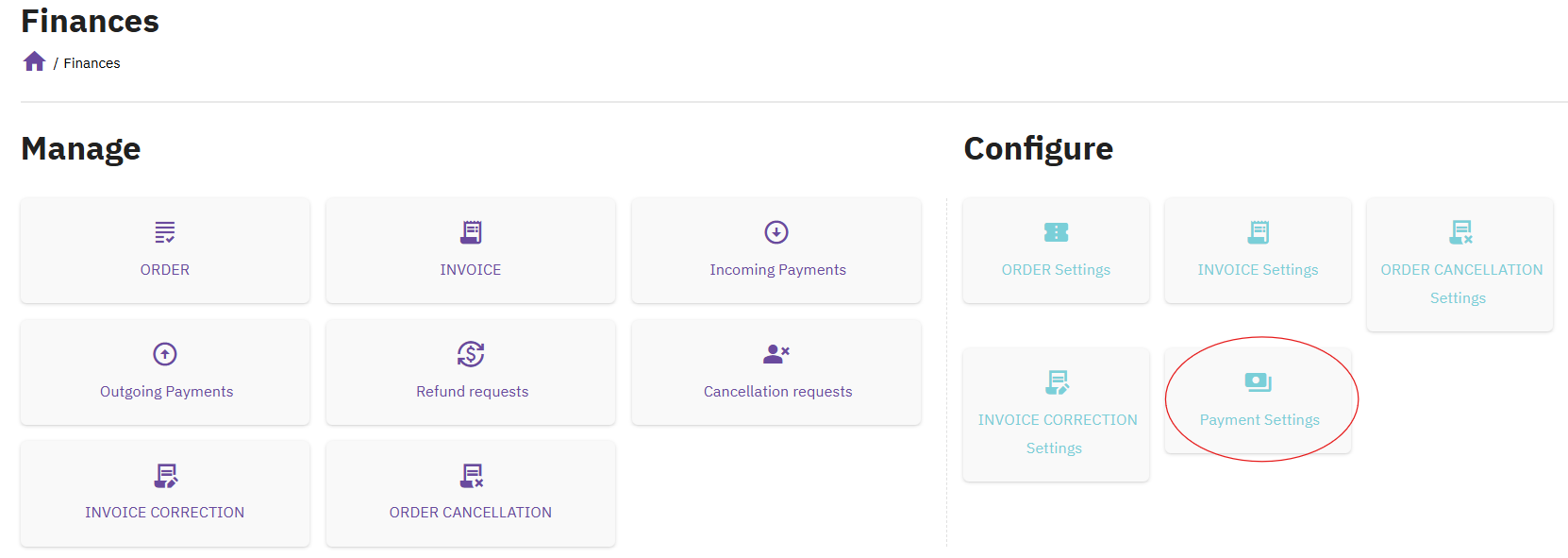

Step 1: Set up Payment Settings

Specify Payment Settings:

- Due days for Payments

- Show Registration number – This information will be visible as part of the Invoice

- Registration Number Required, Tax Id Required, Tax Type Required fields - this information will be required as part of the Attendee Online Registration and Ticketing process, in the Payment step when a Customer is buying as a company (not as individual)

Step 2: Set up your Invoices

Set up your Invoices under Invoice Settings (Event level -> Finances)

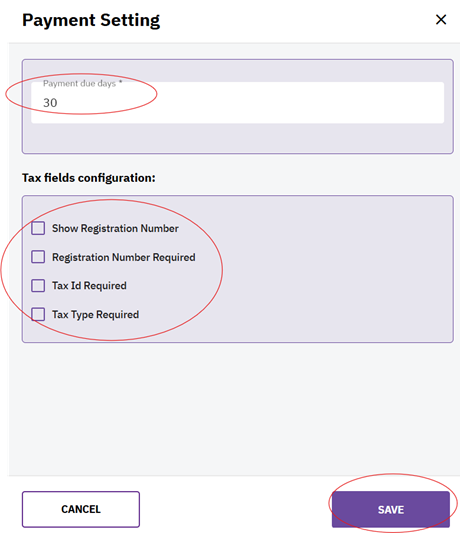

2.1. Configure Invoice Number Settings

- Suggestion: Align with your accountants if needed

The most important thing here is to configure Ticket Serial Numbering, which must be legally compliant with your country specifics

- Add prefix or delete it – sometimes is easier to distinguish invoices dedicated for event connected invoices

- Number needs to stay as it is

- The year you can leave or remove

- Reset number on the year break – mark it if you want that year is changing into a new year

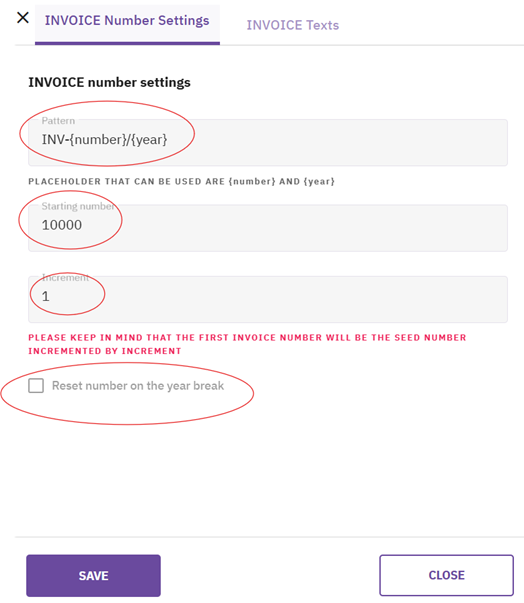

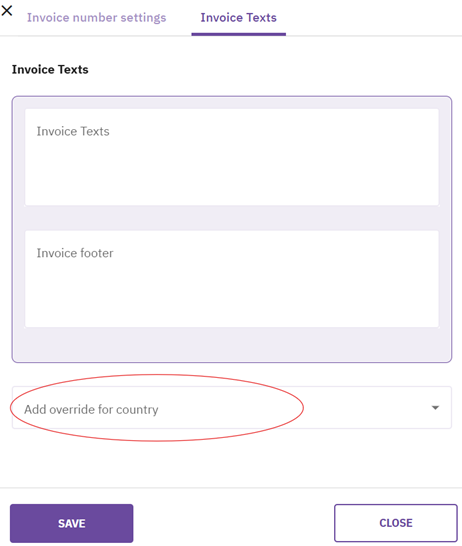

2.2. Configure Invoice Texts

2.2.1. Custom Invoice field text configuration

Include Payments instructions, see an example:

- Bank details: IBAN (account number), BIC, SWIFT code, Bank, Country

- Company details: Company name, Address, VAT, Tax Nr, etc.

- Payment Due date

- Cancellations, refunds instructions

2.2.2. Custom Footer field text configuration

Include Legal Payments instructions, specific for your country see an example:

- Management, Registration information, Capital

2.2.3. If applicable, configure text rules and payment instruction for specific country/ies:

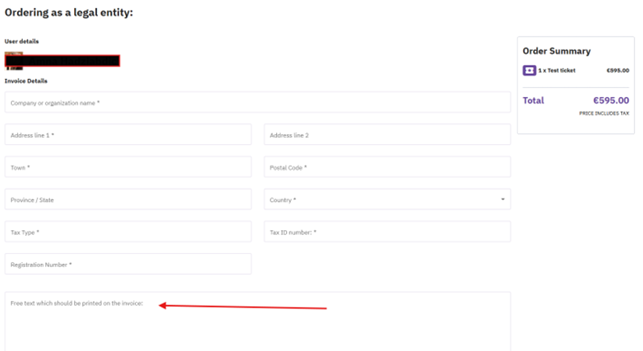

2.2.4. Free Text field for Customers

This free text field will be optional as part of the Attendee Online Registration and Ticketing process, in the Payment step when a Customer is buying a ticket and it will be visible in the Invoice.

Learn more about Invoices/Orders editing: Invoices/Orders editing | Finances | run.events

Cancellation and Refunds

run.events gives you full flexibility and control over your refund policies—with automation that keeps your team and attendees informed every step of the way.

- Custom Refund Policies: Set rules by ticket type, timeframe, or cancellation reason.

- Automated Workflows: Trigger refund actions, notifications, and invoice updates automatically.

- Full or Partial Refunds: Process adjustments with precision, including service fees and VAT corrections.

- Self-Service Cancellations: Let attendees manage cancellations through their personal dashboard.

- Real-Time Reporting: Track cancellation rates, refunded revenue, and trends at a glance.

Step 3: Set up your Orders/Pro-Forma Invoices, Cancellations, Invoice Corrections

- Repeat all the actions under step 2, but based on the specifics for every type of a document

Next steps:

- Working with Invoices | Finances | run.events

- Ticket cancellations and refunds - basic information and settings | Finances | run.events

- Cancelling event tickets and refunding money as an organizer | Finances | run.events

- Approving the Ticket Cancellation Request (no money refund) | Finances | run.events

- Approving the Ticket Cancellation Request which includes a Money Refund Request | Finances | run.events