Tax rules

The run.events platform provides complete support for ticket sales, invoicing, and tax compliance.

Key features and invoicing capabilities:

- Automatic Tax Invoices – Instantly generates compliant invoices for every transaction. Invoices can be customized with event branding and multiple options.

- Multi-Currency and VAT Logic – Built-in handling of international currencies, tax rules, and VAT calculations.

- Refund and Cancellation Handling – Simplifies adjustments to invoices when refunds or cancellations occur.

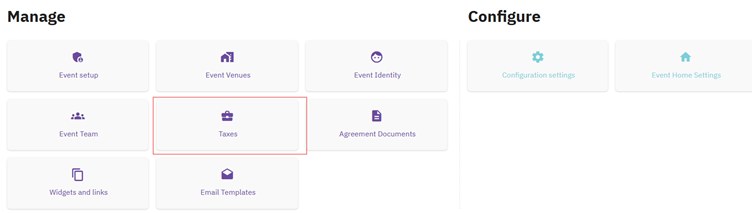

“Taxes” tab

Before configuring the tax rules for your event tickets, we recommend to consult your tax advisor about the exact tax rates that need to be applied to your Ticket Types and Ticket Add-ons.

Taxes can be configured in two ways:

- Go to: Event Settings -> Taxes -> Add Tax rate

or

- Go to: Tickets & Attendees -> Ticket Configuration -> Ticket Type edit button -> Ticket Type “pricing” Tab -> Manage Tax Rules for this event

![]()

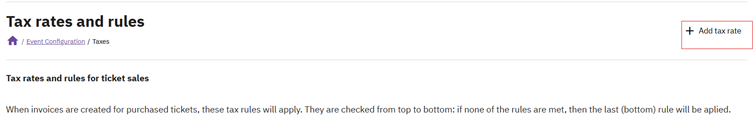

Configuring taxes

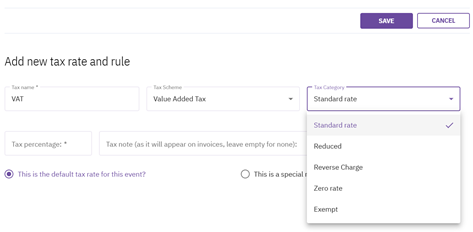

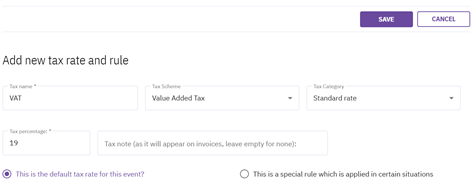

Go to: Tax rates and rule -> Add tax rate:

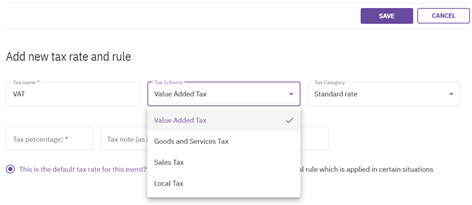

and configure:

- Tax name & Tax Scheme

- Tax Category

- Tax category and Tax note (that will appear on invoices)

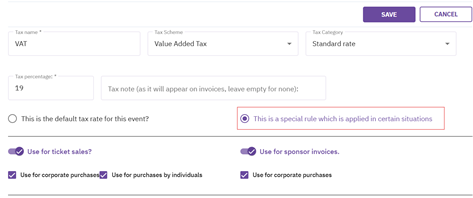

- Define when this special rule applies, such as for ticket sales or sponsor invoices.

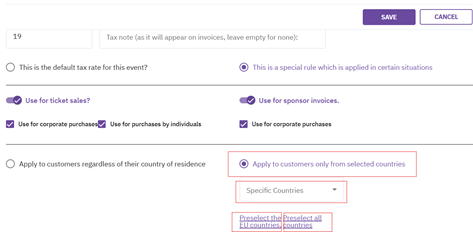

- You can set this rule to apply only to customers from specific countries:

- Specific country/ies

- EU countries

- All countries

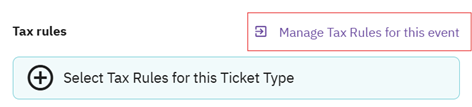

Selecting Tax rules

After configuring all Tax rules, you can select the applicable rule from your list of defined options for a specific Ticket:

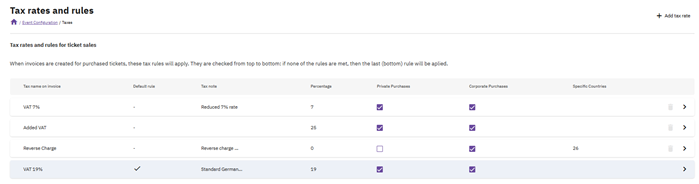

Tax rates and rules for ticket sales - When invoices are created for purchased tickets, listed tax rules will apply. They are checked from top to bottom: if none of the rules are met, then the last (bottom) rule will be applied.

An example:

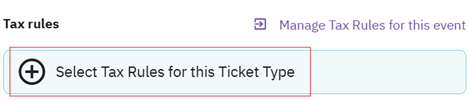

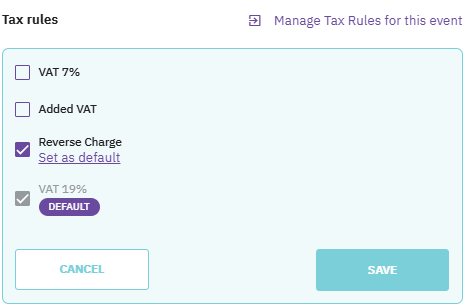

Go to: Tickets & Attendees -> Ticket Configuration -> Ticket Type Edit button -> Ticket Type “Pricing” tab -> Select Tax Rules for this Ticket Type

Choose the applicable Tax rules for this Ticket from your list of available options.

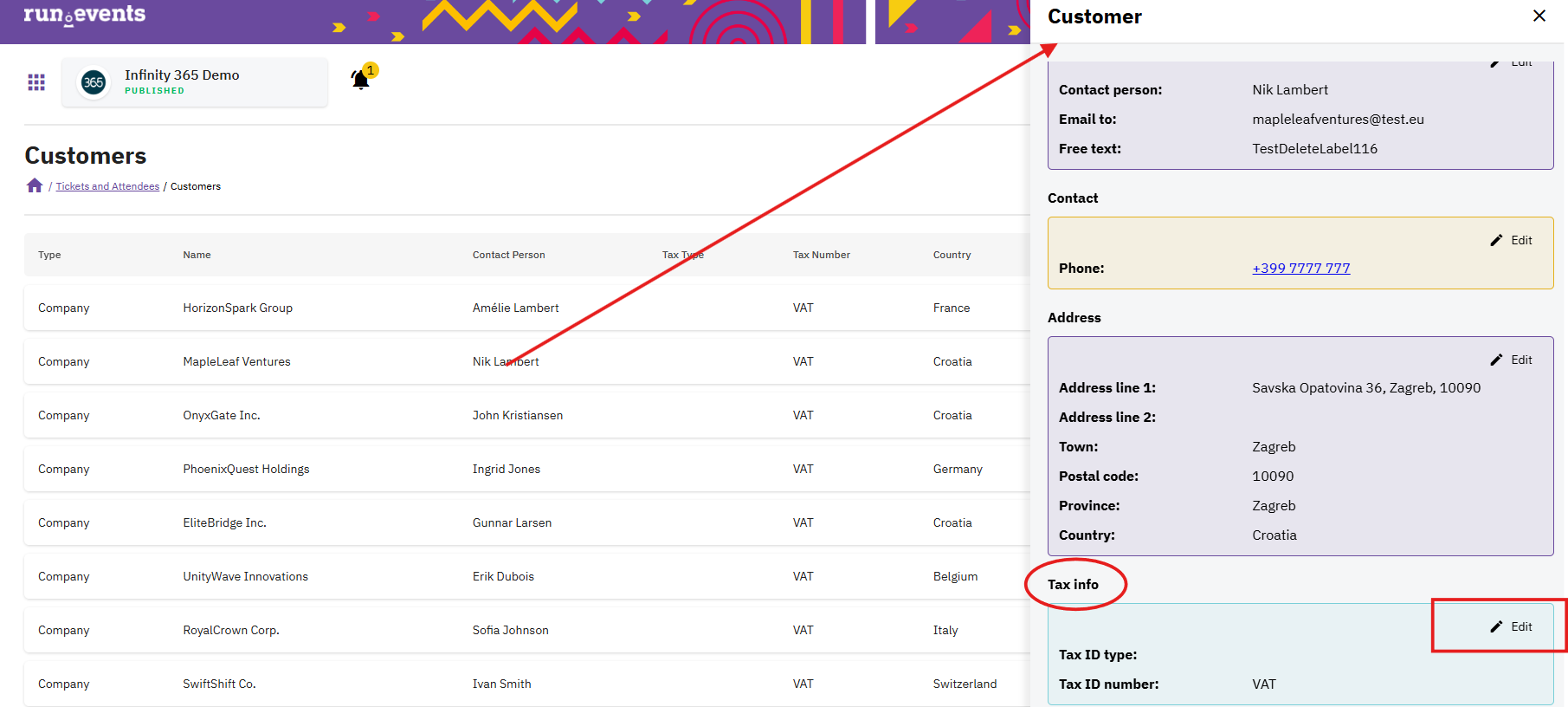

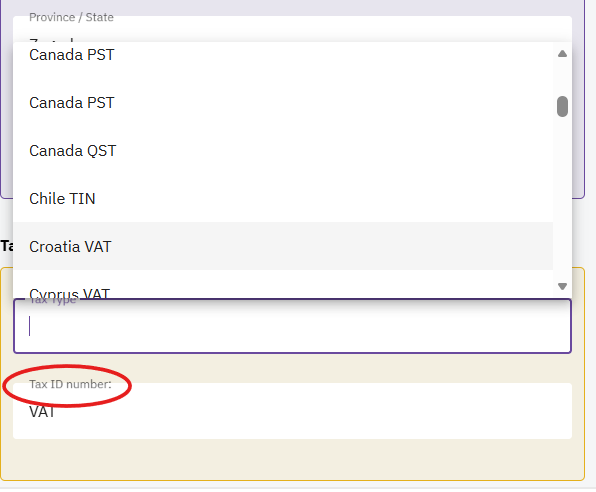

Updating the VAT number for one customer

Go to the Event level -> Tickets & Attendees -> Customers

Click on Customer name

Change/add Customer Tax Type and Tax ID number -> Save

Go to the Event level -> Finance -> Invoice -> Find needed invoice -> Re-send an invoice (or download an invoice)