Bank statement reconciliation

Bank statement reconciliation is the process of matching transactions on a company's bank statement with open and due invoice amounts in run.events. This process helps identifying and entering payment info about bank transfers payments more quickly and easily, and ensuring that all transactions are accurately recorded.

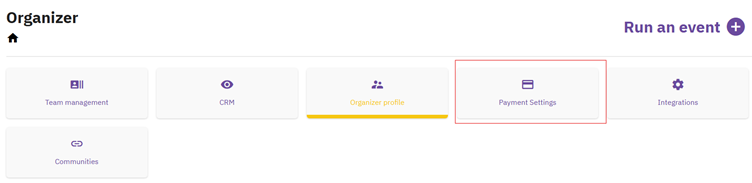

Go to: Organizer level -> Payment Settings

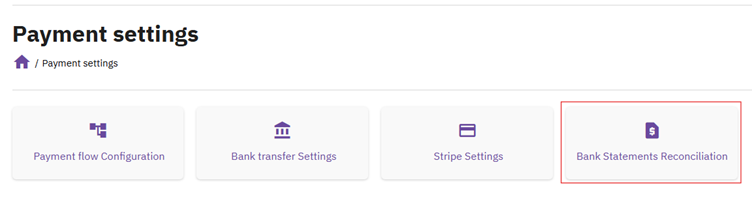

And click on Bank Statement Reconciliation

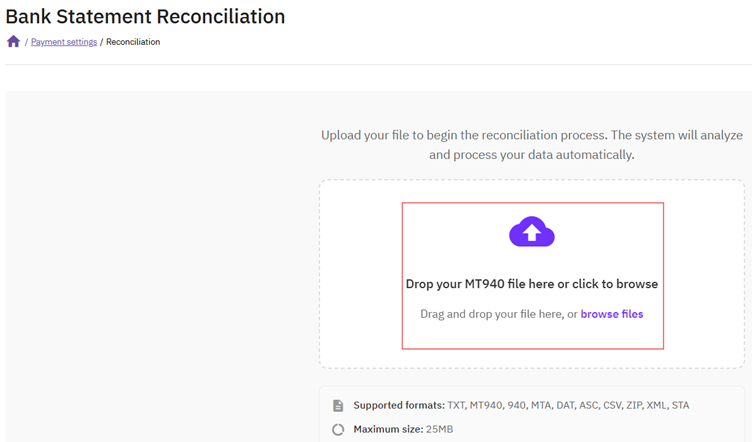

Upload your file to begin the reconciliation process.

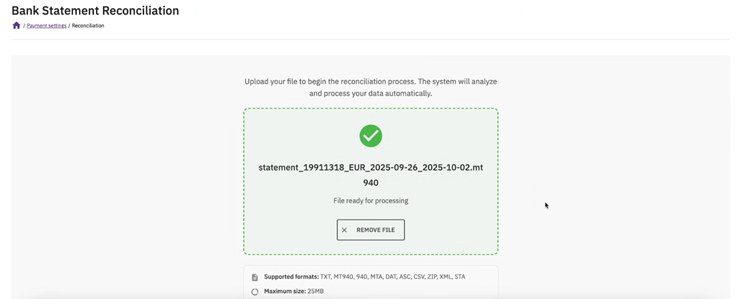

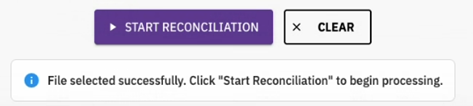

Once the file is successfully uploaded, file is ready for processing:

Click on “Start reconciliation” button:

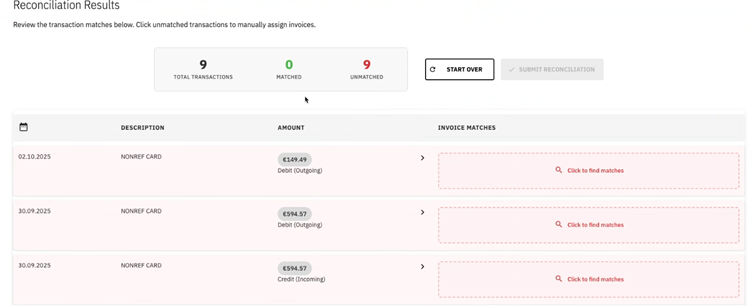

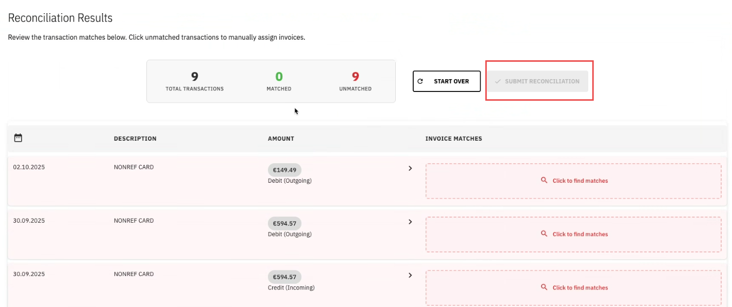

The system will analyze your transactions on the bank statement and identify matches with open and due invoices, based on invoice number and/or amount. If a payment with a specific invoice number has been received in the bank account but is still marked as "unpaid" in the system, it will be displayed as "matched" (indicated by a green number).

By opening the details of a “matched” invoice, you can manually adjust the matching details if needed, and view all related transaction details.

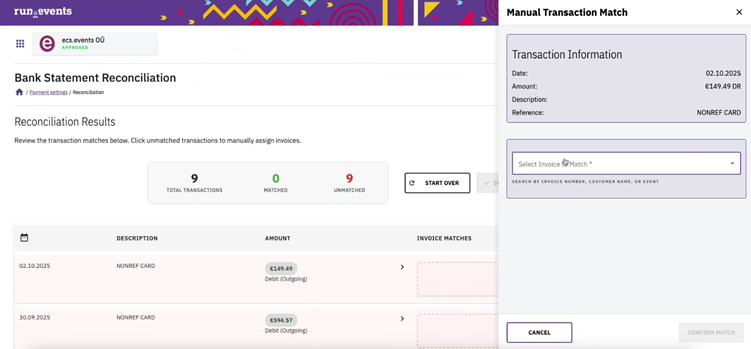

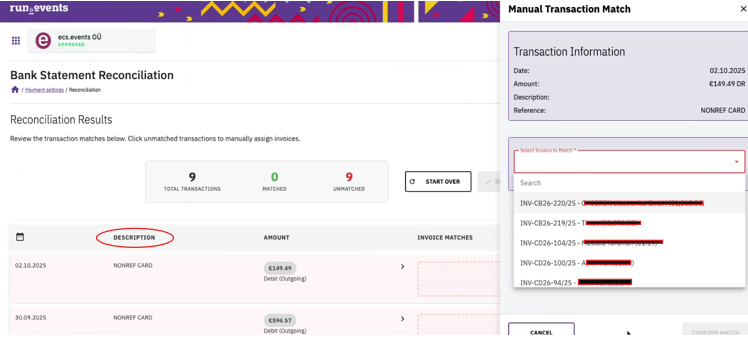

If a transaction could not be matched automatically, for example in case of payments made to your bank without an indicated invoice number, you can manually search for the matching invoice based on other criteria, like the account holder’s name, and select the corresponding invoice from the run.events system that matches the bank transaction.

Once you’ve reviewed all transactions are matched them correctly, click on “Submit Reconciliation” to finalize the process. In this step, payment entries will be created in the system and the matched invoices will be marked as paid.

----------------------------------------------------------------------------------------------------------

More about MT940 file format:

The MT940 file format is a standard structured SWIFT Customer Statement message used for electronic bank account statements. It includes detailed information about account balances, daily transactions, and turnover.

Each file contains data for individual accounts and can be processed by various accounting software. The format, combined with operation codes, ensures accurate booking of transactions in client systems.

Usually, the MT940 file is available through the online portal of the bank or can also be transmitted automatically by secure file transfer.